Currency trading, additionally known as Forex, is performed to earn from buying and selling unique currencies of different international locations. Due to the various change charges, the income earned through the Forex market buying and selling varies. As a currency trader, you’ve got to check when the change costs range for your favorites so you can get the best quantity by buying and selling your forex. There is not any bodily transaction covered in this commercial enterprise. As the Forex buying and selling market is noticeably risky, you need to consider the enterprise’s various factors. Better making plans with a sound understanding of the market will let you earn more from Forex market trading. Here, we discuss a number of the factors that may impact the trading of currency.

Currency Trading

Exchange Rates

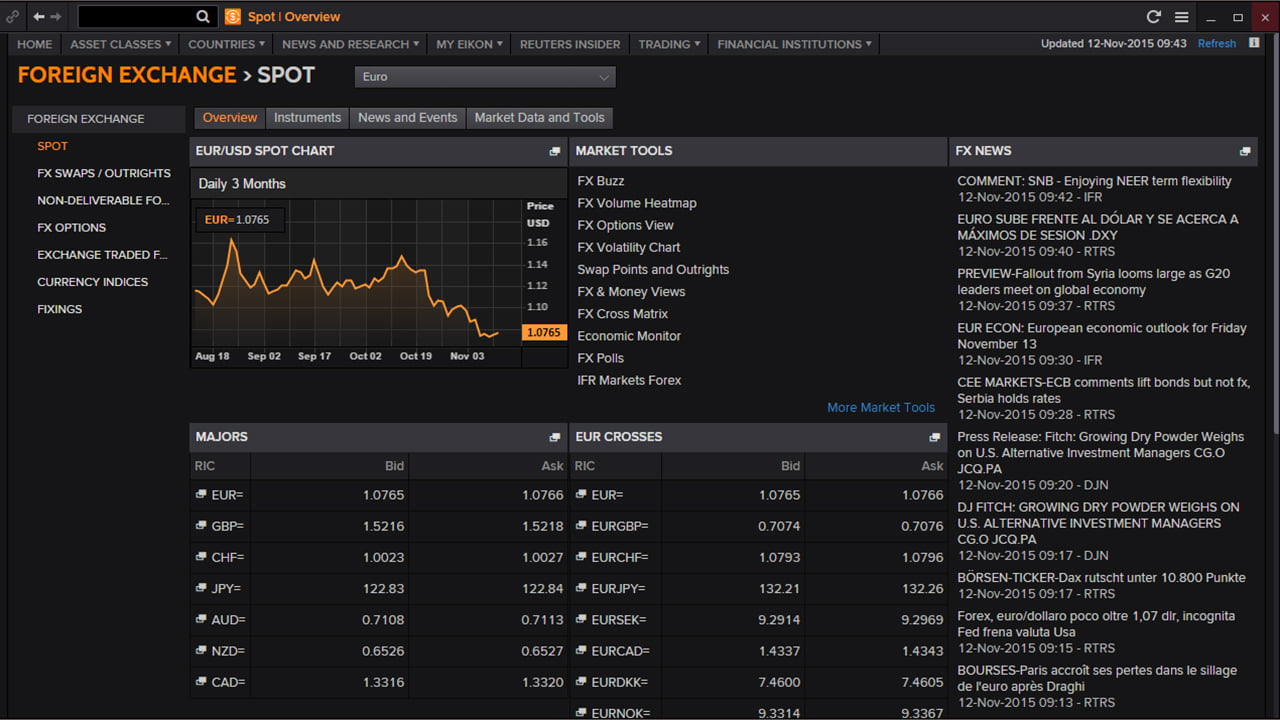

One of the most critical elements in Forex buying and selling is change prices, on which the income is majorly dependent. These are fees at which Forex is bought, bought, or transformed into every other Forex. The constant change fee gadget allows you to trade your Forex for some other one for a fixed price. This is unaffected by the marketplace exchange or some other factors. Fixed exchange fees usually are done for major currencies, including USD or Euro.

When buying or promoting foreign money, investors search for the benefits. Even if the monetary situations are appropriate, traders might experience that the change costs of the currency can also carry losses. Good investors only invest in a currency after deliberating the capability fluctuation and not just the modern fee of alternate.

Inflation

Inflation largely affects the market of Forex. Inflation indicates that the cost of Forex has decreased so that the wide variety of things attainable with foreign money becomes less. If inflation is on the upward push, the cost of the foreign cash gets lesser. If a currency trader knows that the Forex will be doing better soon, even though the prevailing situation is unfavorable, he will buy those currencies. If his prediction is authentic, he will have the money, which could get him large profits later.

Speculation

Speculating that a currency will do in the close to destiny affects the trading of currencies. If you are an experienced foreign money dealer, you may understand the safe coins on which you may make investments that are unaffected by the aid of worldwide monetary changes. It can also occur that when a currency trader is doubtful about which currency to invest in, he supports Forex, which is considered safe.

Changes in the Political Arena

Major modifications inside the political scenario can influence Forex trading. Events, including civil wars, can negatively affect a rustic’s economic state of affairs. In such situations, currency traders appear to invest in secure currencies so that they’re not lost.

Changes in the Economy of a Country

Traders like to invest in currencies of sturdy monetary use. The strength of a financial system is often dependent on proper employment quotes, robust production, and excessive or steady quotes in spending with human beings’ aid.

In the Forex market foreign money pairs, the cost of 1 currency is determined by using its evaluation of any other currency. When the Forex foreign money pairs are quoted, the first foreign money is called the bottom foreign money, and the second foreign money is known as the counter or quotes currency. The base currency always equals one financial unit of change (e.g., EUR, 1 GBP, 1 USD). The forex pair suggests how a good deal of the quote foreign money is wanted to purchase one unit of the bottom currency.

The Forex market foreign money pairs are commonly traded and quoted with a ‘bid’ and ‘ask’ fee. The ‘bid’ is the fee the broker is willing to buy, and the ‘ask’ is the price he’s ready to sell.

For example, if the USD/EUR forex pair is quoted as – USD/EUR = 1.5 and you purchase the team, you get US$ for every 1.5 euros whi sell, you get US$1. If you sell the forex pair, you get a hold of 1.5 euros for each US$1 you sell.

Base Currency

This is the primary currency quoted in the Forex market forex pair. It is likewise called home currency or accounting foreign money and is now and again referred to as the primary currency of a Forex currency pair. For example, CAD/USD is a currency pair. Here, the Canadian dollar is the base currency even as the U.S. Dollar is the quote forex. The fee represents how much the quote currency is wanted to get one unit of the base forex.

China’s Renminbi – Our Currency, Your Problem

This case introduces economic economics fundamentals and demonstrates practical applications of financial rules and change rates that pertain to enterprise decisions. Supporting this case study could be a dialogue at the alternate charge policy that China has followed since 1978, 12 months in which massive monetary liberation occurred. Events in the past couple of years that occurred in China concerning their exchange fee regime had been deemed surprisingly controversial using contributors of China’s exchange companions. This essay’s first objective is to trace the records of this discord surrounding China’s currency, the Renminbi (RMB), which translates into English as “the human beings’ foreign money.” Next, questions from the case will be mentioned. Lastly, the topic will be updated with a brief excerpt regarding the current scenario surrounding this issue.

In 2006, many countries that performed an exchange with China made strong allegations against China’s exchange rate policy. The main complaint was that China’s currency turned undervalued due to China’s manipulation of trade quotes to suppress the charges of its exports. Among other damages, those international locations have claimed that this motion has valued them lots of jobs. The U.S., which had a $233 billion alternative deficit with China that year, threatened to impose import tariffs if China did not revalue its foreign money. Together with Taiwan and Singapore, Japan and newly industrialized economies were much less vocal as they sought to toughen their economic ties with China. Developing Asian countries, but supported a revaluation for them to be better prepared to compete with China. One collective organization that stayed quite mute during the lively debates that ensued within the media between 2005 and 2007 was multinational groups. These corporations benefited from low running expenses in China, which supposed cheaper land and more cost-efficient China-made exports.

China’s trade rate became deemed out of synch with market forces, with several motives to support this end. First, China’s economic system has had nine annual increases over the last decade. According to the Balassa-Samuelson hypothesis, the fast financial boom is accompanied by actual trade charge appreciation due to differential productivity increases between tradable and non-tradable sectors. Secondly, China has become the sector’s 1/3-largest exporter, with at least $970 billion in 2006. China’s exports have experienced approximately 30% growth in recent years. Lastly, there was a compilation of $1.2 trillion in foreign forex reserves. This construct usage claimed to be the result of manipulating the RMB in opposition to herbal forces of the marketplace.

Chinese officers strongly oppose the concept of a revaluation in their currency on numerous grounds, the strongest of which might be that they may be rustic. This is enormously reliant on change, and growth in their exports is crucial. Secondly, over a hundred million rural dwellers have left their farms to find work in city centers. A higher financial increase is necessary to absorb these people into a functional economic system. Apart from the economic motives towards converting the exchange fee policy, officers in China turn to several counterarguments. First, in keeping with them, the RMB is not undervalued, and China’s financial boom has nothing to do with manipulating foreign money. Secondly, the U.S. is strolling a big trade and budget deficit partially attributable to capital inflows from China. It needs to appear to the weak spot in their economy earlier than pointing arms elsewhere. Also, China is a sovereign U. S. With a right to pick its personal change charge coverage. Lastly, Chinese officers delivered the little-recognized reality that notwithstanding its massive alternate surplus with the U.S. And Europe, it also has big deficits with others, specifically Asian nations.

As noted in the introduction, China began liberalizing its u. S. In 1978. Before then, it followed valuable making plans and became reliant on economic self-sufficiency. China’s foreign alternate turned negligible, and there have been infrequently any overseas agencies doing enterprise in China. At that time, the RMB became pegged to a basket of currencies, and a trade fee changed into the set at an unrealistically high level. The foreign money turned into sincerely non-convertible. After 1978, China accompanied an “open door coverage,” and special monetary zones were opened to overseas investments. A tiny personal sector emerged. The RMB changed into devalued in 1981, 1985, and 1993 to the U.S. Dollar for you to sell Chinese exports. The RMB was revalued by using five in 1995, held until July 2005.

Read more:

- How Do Other Countries Devalue Their Currencies?

- An Introduction to the World Reserve Currency

- Currency Rates – Online Trading

- Foreign currency trading Foreign money Shopping for and promoting – How Does Foreign currency trading Foreign money Shopping for and promoting Function?

- The Forex market Trading – Make Money Through Fluctuating Currency Prices